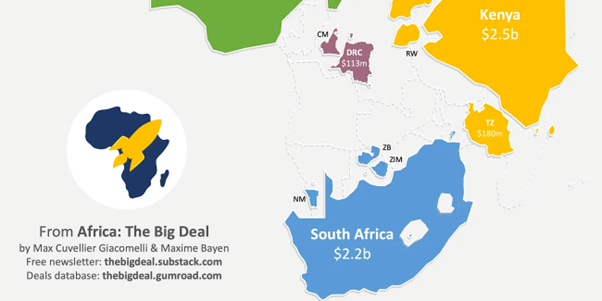

Africa: The Big Deal, a platform dedicated to investing in African technology, recently published an original map. "We thought we'd try something different and bring you a more visual representation of the geographical distribution of startup funding in Africa, with a map where countries are skewed to reflect the relative amount of equity and debt funding raised in each market since 2019," says Max Cuvellier Giacomelli, head of Mobile for Development (M4D) at the GSM Association, in a weekly publication.

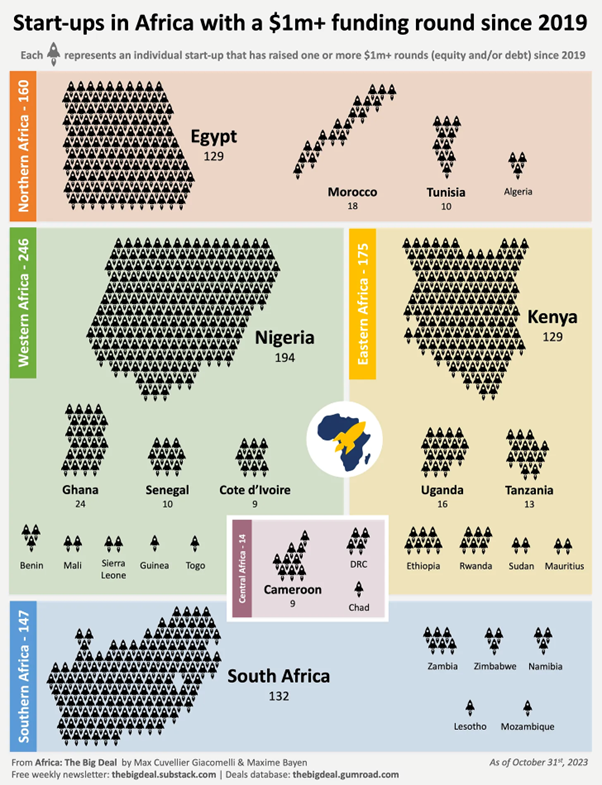

The conclusions are still very interesting. While they confirm the clear lead of the "Big Four", the four most attractive countries, namely Nigeria, Kenya, South Africa and Egypt, the analysis also reveals other aspects.

"The performance of certain markets is heavily dependent on a handful of deals, sometimes even on a single company”

"What do we see here?" analyses Max Cuvellier Giacomelli, "the four main countries continue to dominate. Nigeria, in particular, has claimed more than a third of all financing since 2019 ($4.2 billion) and three hundred transactions of at least $1 million. Some way behind the Nigerian giant, Kenya, South Africa and Egypt are neck-and-neck, with around two hundred deals of one million dollars or more each".

Furthermore, the author continues, "seven markets claimed more than one hundred million dollars over the period: Senegal, Ghana, Algeria, Tanzania, Tunisia, Uganda and the Democratic Republic of Congo, in that order". He added: "As is often the case, you have to read between the lines. Indeed, while Ghana has hosted forty-two deals worth more than $1 million since 2019, the performance of some markets is heavily dependent on a handful of deals, sometimes even a single company. This is the case of Algeria’s Yassir, which raised $180m, or 97% of all funding raised in the country, and to a lesser extent Senegal’s Wave (78%)."

Another group of six countries did not quite reach the $100 million mark, but received on average at least $500,000 per month over the period: Benin, Morocco, Côte d'Ivoire, Rwanda, Ethiopia, Cameroon and Zambia. Morocco deserves a special mention. "This is one of the markets where a single deal/venture is not responsible for most of the fundraising, but also because the number of deals over $1 million since 2019 (twenty-two in total) is higher than for most countries in the $100 million club and above."

Eleven markets make up the rest of the list, with less than $25m raised since 2019, sometimes much less. With the exception of Zimbabwe, which is home to nine startups, each of these markets has only one to three startups that we have tracked since 2019. It's also possible that our thresholds have caused us to miss a few deals worth more than a hundred thousand dollars in 2019 and 2020.

"In total, twenty countries are completely absent from this map because we have not recorded any financing activity since we started tracking them in 2019," concludes Max Cuvellier Giacomelli. These countries include Gabon and Somalia.