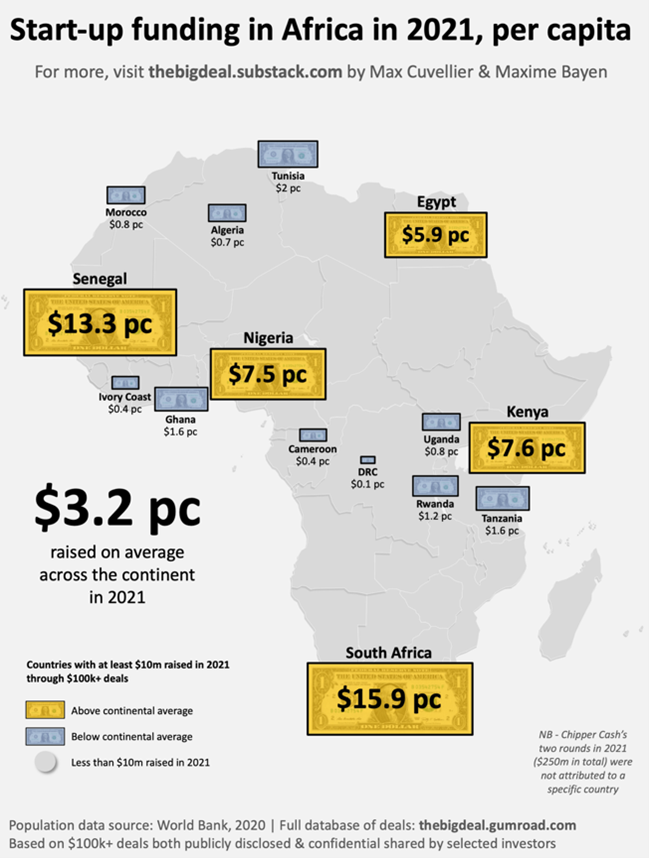

4.3 billion dollars. That's the amount raised by African startups in 2021, more than double the amount of the previous year ($1.7 billion), according to estimates by the specialized website Africa, The Big Deal. In detail, 818 rounds of financing were recorded during the period (including 754 fundraisings of more than $100,000)-a figure that is 73% higher than in 2020-with more than 800 investors involved in at least one transaction. And while some of the trends seen in previous years seem to have continued into 2021, starting with the predominance of the English-speaking region and a concentration of funds on fintech, the past year has also been characterized by increased geographic and sector diversification in private equity deals.

“2021 has been a year of extraordinary growth for the African start-up scene”, notes Max CUVELIER of The Big Deal, who specifies as a preamble to his analysis that "South Africa is the only continental market to show consistent strong growth" since the launch of their database in 2019: from less than $100 million in 2019 to nearly $1 billion in 2021! The other three major African private equity markets-Kenya, Nigeria, and Egypt-also show growth over the period, but in different patterns: Kenya, for example, had a particularly strong year in 2020, when the country topped the rankings, but failed to maintain the same levels in 2021. Nigeria, for its part, recorded a drop in activity in 2020 but rebounded massively in 2021, thanks to a few "mega-deals”. As for "Egypt, initially slower in its growth, its progression in 2021 was the strongest of the group, with the amount of operations financed increasing by a factor of 4.2 compared to the previous year," explains Max CUVELIER.

Moreover, while South Africa, Kenya, Nigeria and Egypt remain at the top of the ranking, with 81% of the total funds raised, other destinations on the continent are gaining momentum. The Big Deal's teams note that "a few countries have experienced steady growth between 2019 and 2021, such as Senegal (even without counting the $200 million round of funding from the American-Senegalese startup Wave), Tanzania, Cameroon and Tunisia" while "Morocco, Rwanda and Ivory Coast have shown strong growth rates between 2020 and 2021, with a more than tripling of funds raised for the first two countries."

Conversely, Uganda, Ghana, and especially Ethiopia, saw a contraction in private equity-related activity last year, with "the biggest underperformance [coming] from Ethiopia, which went from over $10 million in funds raised in 2020 to $3.5 million in funding in 2021."

A blossoming of unicorns

While we wait to see if the giant of the Horn of Africa will rise again in 2022, 2021 saw the emergence of several African unicorns, with twelve mega-deals of more than $100 million concluded in 2021, compared to only two in 2020. Similarly, while fintech remains the sector of choice for investors, with $2.3 billion in funds raised (53% of total funding), interest in transport/logistics platforms and e-health has increased, with the latter sector no doubt boosted by the Covid 19 pandemic.

The only downside, and one that persists, is the predominance of men at the helm of startups that have managed to raise funds. Only 1% of these start-ups are led by women. They still struggle to access funding.

Western investors using local partners to better assess risk

As for investors, The Big Deal study underlines that a majority of venture capitalists involved in operations come from Western countries but that these financiers are increasingly accompanied by local partners, who know the risks and better understand the market potential. Another trend to follow...