AVCA - the African Private Capital Association, a pan-African body advocating for private investments in Africa, recently released its annual report on venture capital in Africa. It confirms expectations of a decline in private capital due to the general context.

Indeed, in 2023, inflation in Africa reached record levels, averaging 17.8%, the highest figure in over a decade. This inflation was fueled by rising global food and energy prices, as well as domestic factors such as fiscal extravagance and national currency depreciations against the US dollar. African central banks maintained high-interest rates to control this inflation, but local currencies continued to struggle against inflationary pressures and increased capital controls.

Caution and decrease in investments

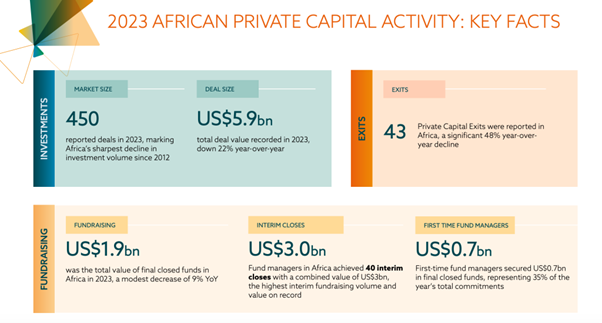

This economic situation had repercussions on private capital activity in Africa. Fund managers exercised caution in their investment strategies, leading to a decrease in the number of investments and exits compared to 2022. Venture capital investments were particularly affected, with a significant decrease in the number of transactions and investment sizes. Despite these challenges, 2023 saw overall resilience in Africa's private capital industry.

Venture capital investments were hardest hit in 2023, with a 28% decrease in the number of transactions compared to the previous year. Investments in this sector were significantly reduced, impacting overall private capital activity in Africa. Sectors such as financial services were affected, with a 47% decrease in the number of transactions.

"A record number of interim fundraising rounds demonstrating investors' continued confidence in Africa's private capital industry”

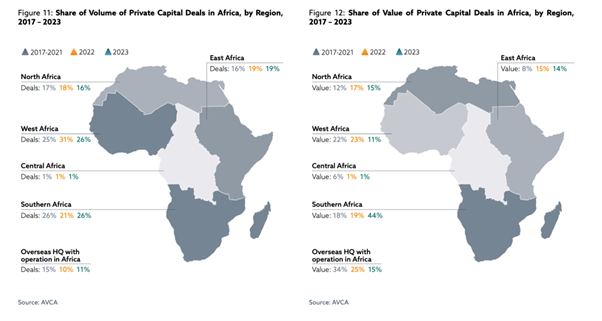

Exits were also impacted in 2023, contracting by 48% compared to the previous year. All regions experienced a decline in exits, with the North Africa region being the most affected. However, despite this significant decrease, the volume of exits in 2023 matched pre-2022 averages, indicating a return to normalcy in the African exit market.

Fundraising was also affected in 2023, declining for the second consecutive year. However, fund managers managed to achieve a record number of interim fundraising rounds, demonstrating investors' continued confidence in Africa's private capital industry. First-time fund managers also recorded remarkable performance, dominating the market for small funds.

In conclusion, the report states that despite persistent economic challenges, Africa's private capital industry demonstrated resilience in 2023. While venture capital investments and exits were affected, overall transaction volumes remained high, reflecting investors' continued confidence in the long-term potential of the African continent.

Consult the report