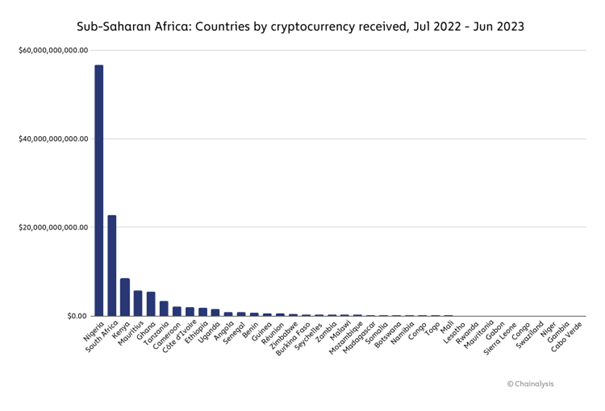

This is one of the lessons of the report on the geography of cryptocurrencies 2023, to be published in October, in the Top 20 of the global crypto adoption index 2023, only two African countries appear. Nigeria is in second place, Morocco in twentieth. The other overall lesson is that the Central, South Asia and Oceania (CSWA) region dominates the top of the index, with six of the top ten countries located in the region. In detail, the authors indicate that popular adoption of crypto does not depend on which countries have the highest gross transaction volumes. “ We want to highlight the countries where ordinary people are adopting crypto the most, explain the report's authors. To do this, we designed the Global Crypto Adoption Index to identify countries where most people are investing the largest share of their wealth in cryptocurrency.”

Challenges to overcome for better profit

Even if the place is brilliant in the ranking, Africa has significant challenges to overcome in reaping maximum profits from cryptocurrency. According to a report entitled Emurgo, “the development of the African crypto industry will necessarily require good collaboration between participants and regulators. As the need for regulation of blockchain and cryptocurrencies increases, key stakeholders must work closely with regulators. This will ensure that risks that may arise as a result of regulatory changes are sufficiently mitigated. The authors believe that adopting transparent regulations will increase blockchain use cases. Which will stimulate new investments and explode the crypto market in Africa.”

Central banks to the rescue

Today, the prospects for cryptocurrency in Africa are all the more important as central banks are investing in it. Today, almost all the ingredients are so much so that African central banks are working on issuing digital currencies. According to a report from the American study center Atlantic Council, countries such as Mauritius, Morocco and Algeria are studying this option. Moreover, Nigeria has already launched its electronic currency eNaira in 2021. And the trend is global. According to a study by the Bank for International Settlements (BIS), by 2030, some 24 central banks are expected to have launched a digital version of their currency, fifteen of the projects could be central bank currencies aimed at a broad audience and nine of the so-called “wholesale” versions, that is to say intended for transactions between central banks and financial institutions.