The Central Bank of Tunisia (CBT) achieves a historic milestone by joining the Pan-African Payment and Settlement System (PAPSS), demonstrating its commitment to regional economic integration. This decision, announced after the signing of the agreement by the Governor of the CBT, Marouane El Abassi, illustrates the country's ongoing efforts to strengthen its commercial ties with the rest of Africa. It also represents another actor in the deployment of PAPSS.

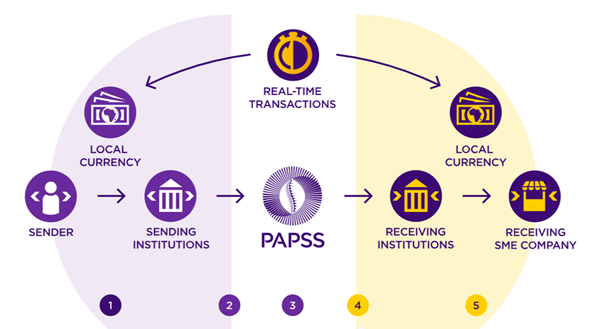

PAPSS, launched in January 2022 by Afreximbank as part of the African Continental Free Trade Area (AfCFTA), aims to simplify cross-border commercial transactions in local currencies among African countries. Its ambitious goal is to create the world's largest free trade area, connecting over 1.2 billion consumers with a combined GDP of over $2.5 trillion.

In partnership with the Association of African Stock Exchanges (ASEA), PAPSS aims to revolutionize cross-border stock exchange payments in Africa. This strategic partnership, formalized by the signing of a protocol agreement during the ASEA 2023 Building African Financial Markets seminar in Victoria Falls, Zimbabwe, demonstrates the commitment of both entities to promote cross-border payments and the integration of African capital markets.

PAPSS facilitates cross-border payments in local currency, enabling African investors and businesses to conduct faster and more cost-effective transactions. Through ASEA, PAPSS strengthens the African Exchanges Linkage Project (AELP), thereby facilitating cross-border securities trading in Africa. Already operational in several West African countries, PAPSS is rapidly expanding across the continent, promoting financial integration and intra-African trade.

Another significant agreement is the one signed between Ecobank and PAPSS to facilitate cross-border financial transactions. This partnership will enable Ecobank subsidiaries in 33 African countries to expedite fund transfers while ensuring transparency and compliance, in line with the African Union's vision to promote intra-African trade and economic integration.

A catalyst for E-commerce development in Africa

PAPSS also promises to catalyze the development of e-commerce in Africa. By simplifying cross-border financial transactions and reducing associated costs, PAPSS creates an environment conducive to the growth of online commerce across the continent. African businesses, now able to process cross-border payments more efficiently in local currency, can expand their reach and customer base, thereby driving the growth of the digital economy on the continent. This increased potential for e-commerce contributes to job creation, promotes innovation, and enhances economic connectivity within Africa and beyond.

Despite these advancements, the adoption of PAPSS falls short of expectations. Kenyan President William Ruto calls for a mobilization of African central and commercial banks to accelerate adoption of the system. With PAPSS, Africa has an unprecedented opportunity to strengthen its economic integration and drive sustainable growth across the continent.